ZTIP - BMO Short-Term US TIPS Index ETF

You can access a suite of US Treasury-Inflation Protected Securities here in Canada with your choice of hedged, unhedged or USD.

Why ZTIP?

1. Protection against surprises in higher inflation.

2. Short duration to manage interest rate risks.

3. Safety of US government backed debt

| ZTIP tracks the Bloomberg US Government Inflation-Linked 0-5 Year Bond Index, focusing on the short end of the curve to provide more of a pure play on inflation by avoiding longer duration risk. ZTIP or Treasury-Inflation-Protected Securities have been designed to protect investors against inflation. The bonds have a government backing, and pay investors a fixed interest rate as the bonds par value adjusts with the inflation rate. |

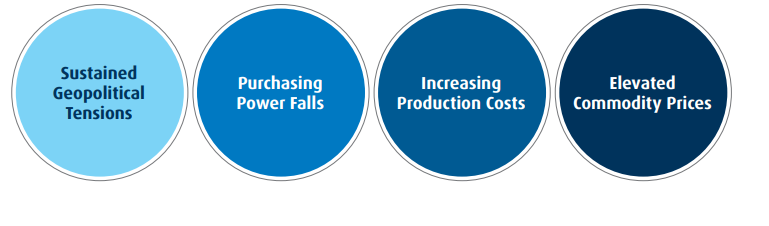

Signs you should be protecting against inflation:

How do Treasury Inflation Protected Securities Work?

• ZTIP pay interest twice a year based on a fixed rate

• The principle value of ZTIP adjusts up and down based on inflation as measured by Consumer Price Index (CPI)

• The rate of return received by investor reflects the adjusted principal

Example:

The Treasury issues a US TIPS with $1000 face value and 3% coupon.

Year 1: Investor received $30 (in two semi-annual payments). That year the CPI increases by 4%. As a result, the face value adjusts to $1040.

Year 2: Investor received the same 3% coupon, but based on new, adjusted face value. Therefore, the investor received income of $31.20.

Year 3: CPI drops by 2%. Face value rises to $1060.80 and investor receives interest of $31.82.

The TIPS’ payout consists of two parts: the increase in CPI and the “real yield,” or the yield above inflation. Once the bonds mature, investors receive either the adjusted, higher principal or their original investment, whichever is greater.

Download PDF >

“BLOOMBERG®” and the Bloomberg Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by BMO Asset Management Inc. (the “Licensee”). Bloomberg is not affiliated with the Licensee, and Bloomberg does not approve, endorse, review, or recommend the ETF. Bloomberg does not guarantee the timeliness, accuracy, or completeness of any data or information relating to the ETF.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.