Three Reasons Why the USD Remains Under Pressure

April 21, 2025For today’s note…

- Why the USD continues to be under pressure

- Canadian election - notes on the Liberal and NDP fiscal plans

- Portfolio strategy thoughts - why the gap between US/non-US should widen

1.) A Riff on the USD

In our minds, there are three major reasons why the USD continues to come under pressure.

i.) Increased trade and capital barriers – and what both mean for the US economy over the long-term.

Tariffs are easy enough to understand as trade barriers, but countries are now also looking at measures to curtail the flow of capital to the US. For instance, the Chinese government is pressuring state-backed funds to cut off new investments into US private equity. At the margin, this raises the cost of capital for US firms and hurts their productivity profile over the long-term.

ii.) A loss of faith in US institutions.

An example of this is Trump’s repeated attacks on Fed Chair Powell and the risk that the Fed’s independence could be impaired.

Both i) and ii) contribute to a re-pricing of the ‘American exceptionalism’ theme.

iii.) Idiosyncratic themes in large surplus countries that are pushing domestic yields higher.

For instance, Germany’s embrace of expansionary fiscal policy over the long-term means that the neutral rate for the ECB shifts higher as well (monetary policy won’t need to be as expansionary as in the past). In Japan, higher yields suggest that savings don’t need to be recycled elsewhere at the margin.

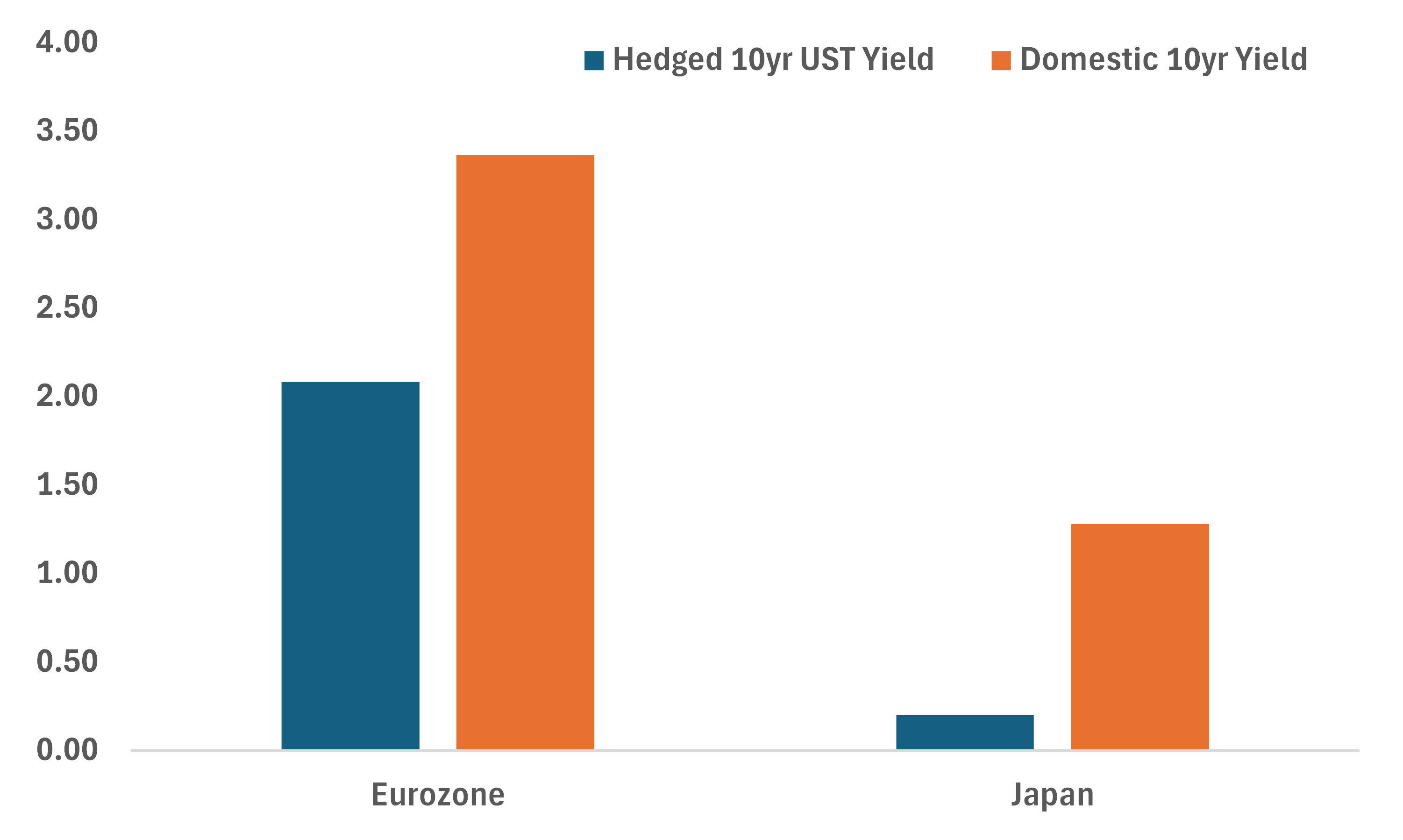

What that means is that domestic yields for European and Japanese investors are now higher than FX-hedged UST. For instance, a European investor can pick up 128bps on 10-year Greek debt over a 10-year UST that is currency hedged. For Japanese investors, that works out to around 107bps (see Chart 1).

All of the above supports the migration of investment flows from the US to other countries and a recycling of savings into hard assets like Gold. Indeed, we are in the midst of a massive shift in foreign portfolio allocation away from the USD-underlyings which does have a structural feel to it.

Trying to call a bottom in the USD is like catching the proverbial falling knife right now. We underestimated the near-term ability of the USD to decline in the manner that it has and our advice to our readers would be to stay nimble here.

Chart 1 – For European and Japanese Investors, Domestic Bonds Offer Higher Yields Than Hedged USTs

*Eurozone domestic yield is Greek 10-year yield

Source: BMO GAM

2.) Canada News + Notes

a.) The latest projections indicate the following:

- The Liberals are expected to 188 seats (-6 from last week)

- The Tories are expected to win 125 seats (+3 from last week)

- The BQ are expected to win 22 seats (+4)

- The NDP are expected to win 7 seats (no change from last week)

Remember, the above values represent the mean of a gaussian distribution for each outcome for each party. They won’t add to 338 for that reason.

The odds of a Liberal majority are now at 70%. That’s shifted slightly lower over the past few weeks.

b.) Thus far, only the Liberals and the NDP have released fiscal and costing plans. The PC is expected to do so in the coming days.

You can find the Liberal fiscal and costing plan here. The baseline forecast corresponds to the PBO’s own release on March 24th.

Here are a few of the highlights from my own notes:

- The plan calls for $129bln in new spending over the next four years with the majority coming in the first two fiscal years.

- For the coming fiscal year, the largest outlays will come from revenues foregone as part of the tax cut to the lowest bracket (from 15% to 14%), trade diversification initiatives, and the ‘Build Canada Homes’ project.

- In the latter two years, the largest outlays will also include defense spending.

- The Liberals are assuming a $20bln intake from tariff responses for this fiscal year. Meanwhile, the improved efficiency measures are expected to add $28bln over the next 4 years.

All told, the cumulative deficit will expand by $83bln over the next four years relative to the baseline under the Liberal plan. PM Carney has rationalized this by emphasizing the crisis that the Canadian economy is currently facing given that the trade backdrop with the US has changed.

Embedded within the Liberal forecasts, we estimate that they’re projecting a nominal GDP decline of about 2.5% this year, followed by an average of 3.5% growth over the next three years.

c.) The NDP platform is available here.

- The plan calls for an increase of about $48bln to the deficit over the next four years.

- Excluding outlays for interest and contingencies, we estimate total outlays are around $194bln. Those are offset by a wealth tax on those with wealth above $10mln (expected to yield around $95bln over four years), a surtax on corporations earning over $500mln ($6.6bln), and closing tax loopholes ($25bln).

c.) Coming up this week – we have the release of SEPH employment for February (Canada’s version of non-farm payrolls) and retail sales (for Feb) on Friday.

3.) US News + Notes

a.) Over the weekend, Trump posted on Truth Social that his definition of “NON-TARIFF CHEATING” (his emphasis) includes: currency manipulation, VATs, dumping, export subsidies, protective agricultural/technical standards, counterfeiting/IP theft, and transshipping.

b.) To those who keep asking/wondering what the ultimate strategy is for tariffs – please read this article.

To summarize, there is no grand scheme or over-arching strategy for tariffs. They’re there because Trump is an ardent believer of them and has been for a long time. Right now, they’re about isolating China. Tomorrow? That could change and he’ll be talking about them as revenue sources primarily.

This is what makes the backdrop so challenging to navigate. The President’s views remain the same directionally but change in magnitude depending on the last person he spoke with.

We’re still reluctant to jump back into broad risk given that the potential for headline volatility remains high ahead of the expiry of the 90-day reciprocal tariff moratorium (July 10th). Additionally, we’ve yet to see how big of a hit the tariffs will represent for broad earnings and macro data. That should show up soon, however.

c.) For those that missed it – we shared our thoughts on the Trump/Powell feud on Friday.

Again, this represents a massive risk for markets. One that absolutely merits keeping an eye on.

d.) For the coming week, we’ll paying close tabs on what the March durable goods data tells us with respect to how tariffs are impacting demand (Thursday).

4.) Portfolio Strategy

As mentioned in 3b), we’re still a bit circumspect when it comes to broad risk. However, we do expect to see the performance gap widen between Canada + EAFE equities and the US. Momentum is clearly on the side of the former which jives with what the FX market is already telling us.

In the US and Canada – we continue to favour low vol as the optimal strategy at this point. We also remain bullish on infrastructure (ZGI) and Gold (ZGLD).

As our reminder, our Q2 Strategy is up and our balanced portfolio consists of the following:

- In the fixed income sleeve - we’re long ZDB, ZBI and ZTIP/F

- In the equity sleeve – we’re long ZUQ, ZLB, ZDI, ZXLV, ZWEN, and ZCH

- In the alternative sleeve – we’re long ZLSU, ZGLD and ZGI

We’re also taking a small cash position via ZUCM.