Weekly Basis Points - Is it Time for Small Caps to Shine?

September 08, 2025Since the end of July, small caps have outperformed in the US. And given that the Fed appears to be on the cusp of re-starting its easing cycle, many have wondered whether this is the start of something special in the US small caps space.

As a factor, size is generally most important when we’re deliberating on whether small or mid caps will outperform the broader market. And we’ll acknowledge that a backdrop of falling interest rates has historically coincided with the outperformance of small caps. Intuitively, that makes sense given that small cap firms tend to rely heavily on debt financing and cheaper borrowing costs point to an increase in net margins.

However, it’s more important to remember that not all interest rate cuts from the Fed have the same effect for the real economy. Indeed, it matters where the starting level of interest rates are relative to what we call the neutral interest rate. That is the equilibrium short-term interest rate that would prevail when an economy is at full employment and when inflation is stable. Admittedly, this is a theoretical interest rate that we cannot reliably point to with precision, but we do know that it exists. If the current level of the Fed funds rate is above this level, then monetary policy is said to be restrictive – because borrowing costs are still high relative to the equilibrium. Conversely, if the Fed funds rate is below this level, then monetary policy is said to be expansionary.

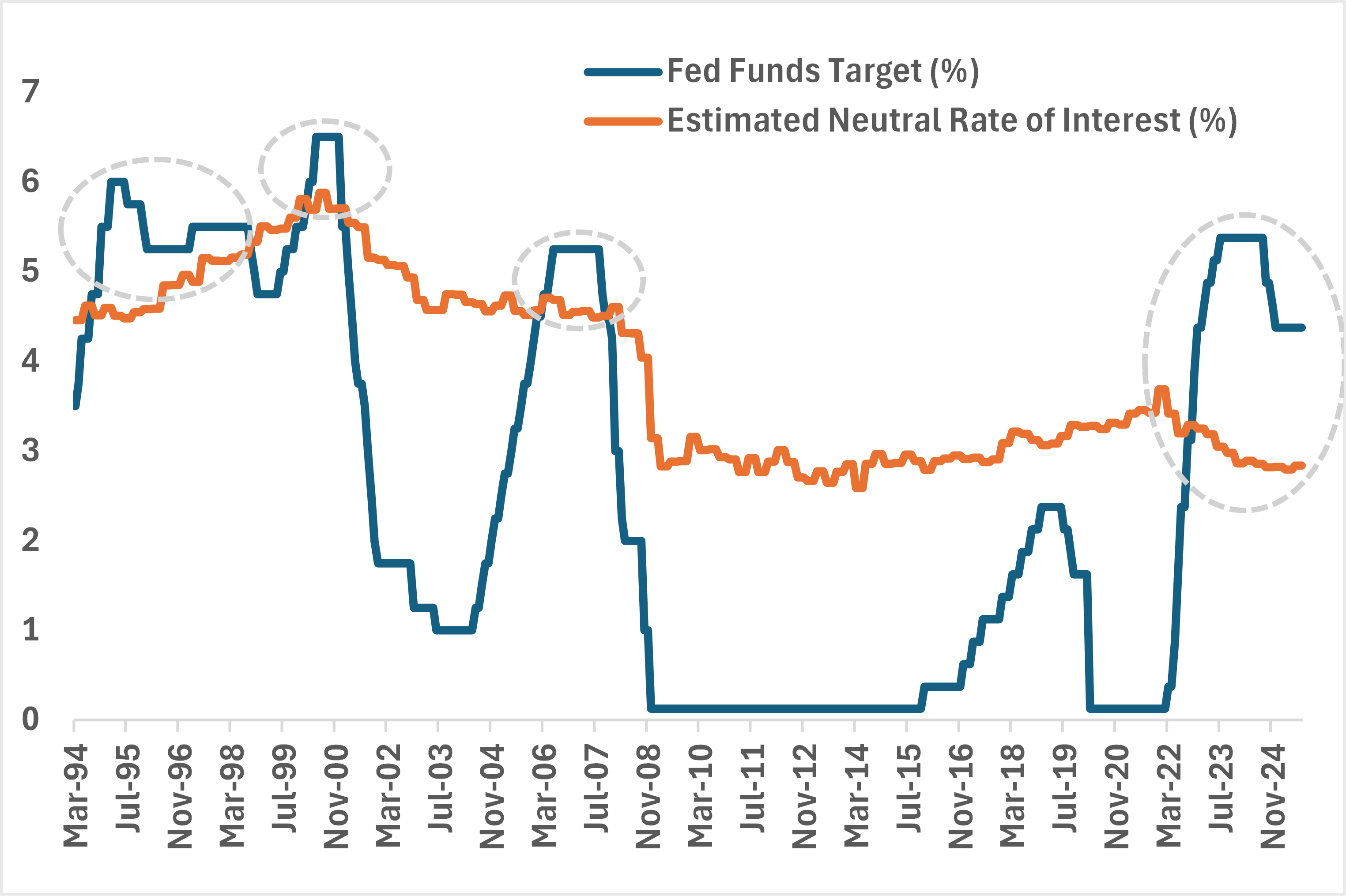

Right now, the Fed funds rate target range is 4.25-4.50% which is well above most estimates of the nominal neutral rate. If we use the Laubach-Williams model then that estimate is just under 3% - once we adjust the real rate for the inflation target. That means that the current Fed policy is restrictive given that the mid-point of the target range sits 137bps above where neutral is estimated to be (Chart 1). The Fed would have to cut at least 5 times before short-term policy rates in the US would be at equilibrium.

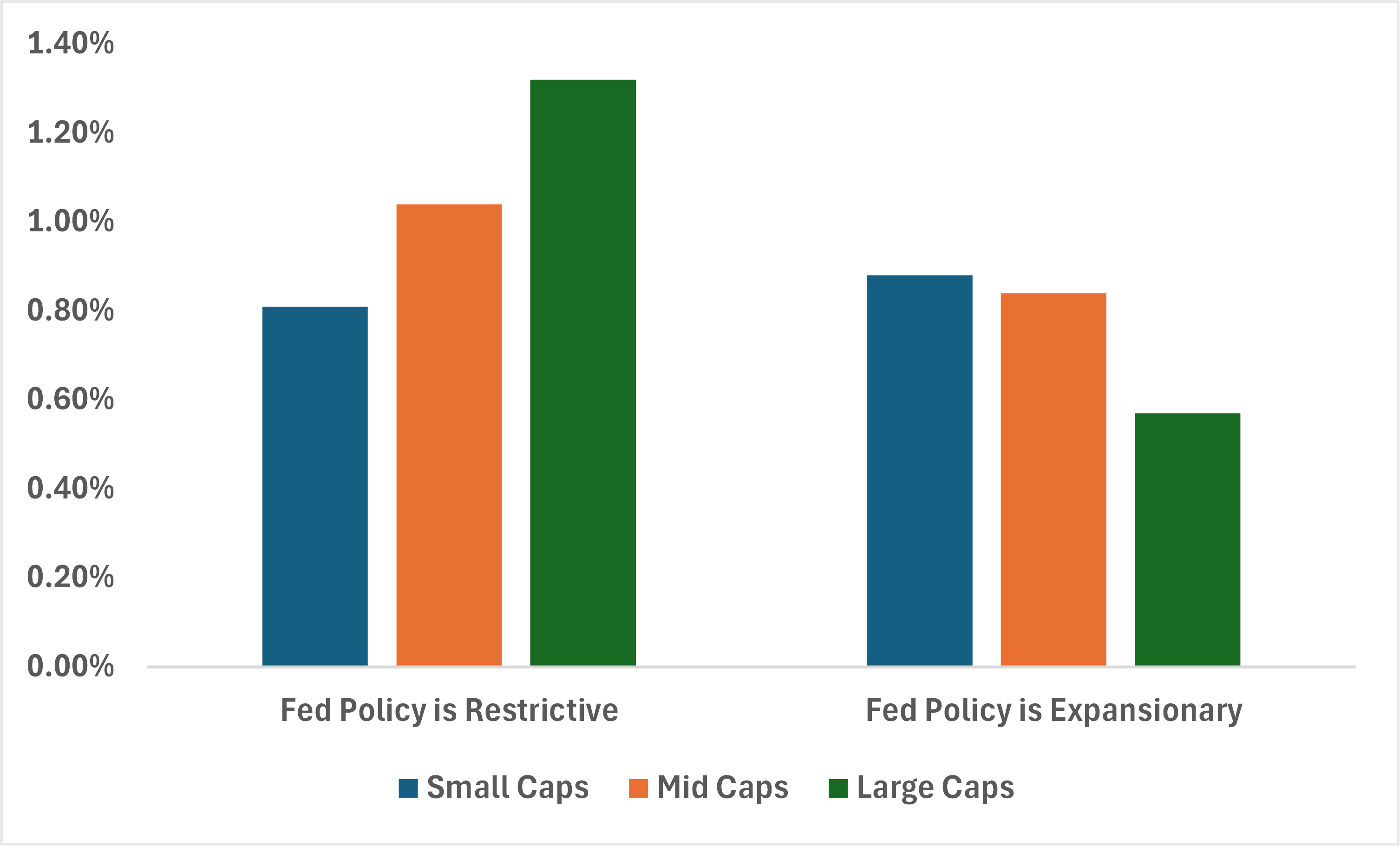

Why does this matter for small caps? Because we’ve noticed that in the past they’ve underperformed whenever Fed policy is restrictive (see Chart 2). Indeed, the average month-over-month gain in small caps is +0.81% which is below that of large caps (+1.32%). On the flip side, small caps will typically outperform when Fed policy is expansionary – with an average gain of +0.88% during those periods looking much better relative to large caps (+0.57%). What this tells us is that a Fed cut when rates are still restrictive does not change the reality that borrowing costs are still too high for a lot of small cap firms.

Chart 1 – Identifying Prior Periods of Restrictive Fed Policy

*Neutral rate of interest is adjusted for inflation target

Source: NY Fed, Bloomberg

Chart 2 – Average Monthly Gains for Different Fed Policy Regimes

Source: BMO GAM, Bloomberg

The time for small caps will come, but we just don’t think it’s now. The rally in the space since the end of July likely speaks to a degree of ‘catch-up’ from a weak start to the year or short covering as opposed to a shift in the underlying fundamentals. That gives this rally more of a tactical slant for the time being – and one that we feel is at the end of its legs in the near-term. As such, we are removing our bullish bias in our tactical positioning (see below).

Instead, our focus in the US equity space remains on quality large caps with a tilt towards tech, communications and utilities as sector plays.

Tactical Positioning

Sometimes it’s best not to overthink things. Everything going on at the policy level in the US is constructive for Gold over the long-term.

New

- ZGLD (BMO Gold Bullion ETF)

- ZWGD (BMO Covered Call Spread Gold Bullion ETF)

Existing

- ZWT (BMO Covered Call Technology ETF)

- ZAAA (BMO AAA CLO ETF)

Changes

- We are removing our tactical longs in ZSML/F (BMO S&P US Small Cap Index ETF - Hedged to CAD) and ZMID/F (BMO S&P US Mid-Cap Index ETF - Hedged to CAD)

Portfolio Strategy

The week is expected to kick off with an important confidence vote in France (which we covered briefly here) on Monday. After that, Apple is expected to unveil the start of a three year iPhone redesign cycle (alongside the launch of the iPhone 17) on Tuesday.

The macro cycle is expected to kick into another gear starting on Wednesday with the release of US PPI ahead of CPI on Thursday. This is one of those rare occasions where we’ll get PPI first – and market sensitivity will be elevated for that print. Remember that the market is now pricing in better than even odds that the Fed will cut by 25bps at each of its next three meetings, and a firmer PPI/CPI profile may remind investors that pricing may need to adjust in kind.

a.) We continue to prefer Equities and Alts over Fixed Income.

- From a factor perspective, we remain bullish Quality

- Within the US, we favour Tech, Communications, and Utilities

- In Canada, we favour Industrials and Materials

- From a regional perspective, we do see US markets continuing to perform. At the same time, we remain constructive on EM equities (particularly China).

b.) For fixed income, we’re underweight in our balanced portfolio.

For the UST market, we expect the front-end to outperform as the curve steepens (a ‘bull steepener’). Inflation-adjusted (or real) yields are also likely to outperform across the curve.

For credit, while both Canadian and US IG spreads are tight, we still see former outperforming going forward. We continue to optimize for ‘high yield + short duration’ with preference for sub-sovereign exposure.

c.) In the Alts space, we continue to like Gold and infrastructure as diversifiers in the portfolio.

d.) We are bearish on the USD. We expect to see the greenback underperform relative to the EUR and CAD. Developments in France are a key risk to monitor with this view.

Asset Class |

View |

Notes |

Equities |

Slightly bullish |

|

Fixed Income |

Slightly bearish |

|

Alternatives |

Bullish |

|

FX |

Slightly bearish USD/CAD |

|

Key Events for This Week

Mon Sept 8

- France: Confidence vote in parliament

Tues Sept 9

- US: NFIB small business optimism (Aug)

Wed Sept 10

- US: Wholesale inventories (Jul – final), PPI (Aug)

- China: CPI/PPI (Aug)

- Brazil: CPI (Aug)

Thurs Sept 11

- US: CPI (Aug), Initial jobless claims, Federal budget balance (Aug)

- Eurozone: ECB decision

- Mexico: Industrial production (Jul)

- Turkey: CBRT decision

Fri Sept 12

- US: Michigan surveys (Sept – prelim)

- UK: Industrial production (Jul), Trade balance (Jul)