Thoughts on the Canadian Election

29 avr. 2025What’s covered:

- A quick summary of the results

- Where do we go from here

- Market implications

- Portfolio strategy going forward

The unofficial tally so far (elected + leading):

- Liberals with 168 seats (43.5 % of the popular vote)

- Tories with 128 seats (41.4 %)

- BQ with 23 seats (6.4 %)

- NDP with 7 seats (6.3 %)

1.) Quick Summary: The Liberals appear to be on track to win 168 seats, which means they’ll fell short of the majority needed for the 45th parliament (which is 172 seats). In stunning news, while the PC made clear gains and mostly outperformed polls going into yesterday, leader Pierre Poilievre will lose his seat.

Additionally, the NDP only managed to eke out 7 seats – which means that they’ve lost official party status and affiliated MPs have to operate as independents. The Liberals may not be able to count on them as part of any ‘confidence and supply’ arrangement. Instead, they might have to seek out an arrangement with the BQ, which could mean additional spending on their priorities (support for the metals sectors, health care).

The next step is the “Speech from the Throne”, which tables the government’s goals and opens the next parliamentary session. At close to (but not quite) majority, and with the PC leader now without a seat, the Liberals can probably rest assure that the opposition parties won’t seek to topple them right away. If that’s not the case, and if there’s not an agreement with another party, the next budget date (likely in June) becomes a risk event to monitor.

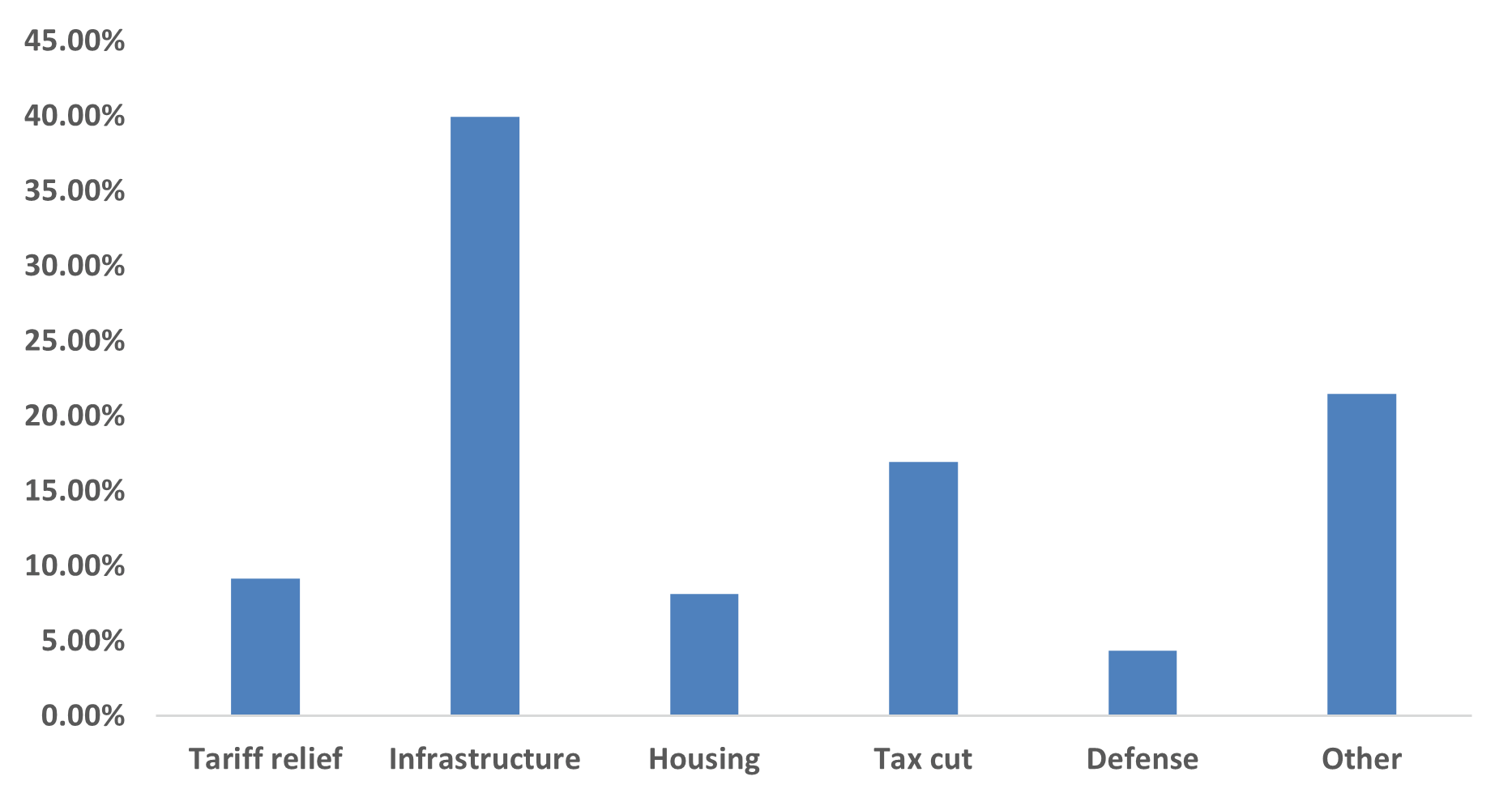

2.) Where Do We Go From Here: The fiscal and costing plan gave us a rough idea of the Liberals strategy. Namely, to spend heavily on infrastructure, housing and other programs to cushion the blow from the trade shock. Indeed, the budget deficit was expected to remain wider than the PBO’s baseline assumptions over the next four years.

However, the Liberals minority victory means the risks are now heavily skewed towards wider deficits going forward (assuming a deal with the BQ), or a watered-down version of their plan (assuming it’s the PC – low probability). Keep in mind, that there is some overlap when it comes to objectives between the two major parties though the priorities are still very different.

Key line items from the Liberal fiscal platform:

- Tax cuts: A 1% cut to the lowest income bracket (from 15% to 14%) + removing GST on new homes for first time buyers (under $1mln).

- Housing: $11.8bln over next four years for ‘Build Canada Homes’

- Tariff relief for affected workers and businesses

- ~$20bln over four years for defense and policing

- ~$30bln over four years for other infrastructure

Chart 1 – Liberal priorities for the current fiscal year (as a percentage of total spending)

Source: Liberal fiscal and costing plan, our calculations

3.) Deficits? Again, there’s a good chance that the deficits might actually come in wider than the Liberal’s platform for a few reasons.

First, the PBO baseline (used by most of the parties) likely overstates GDP growth and the health of the employment sector to a degree. That is largely because the PBO estimates didn’t fully capture the impact of US tariffs on CAD exports. The implication here is that revenues may not be as high as the Liberals project, while expenses might be higher than expected – especially if US tariffs remain in place.

Second, a Liberal minority government potentially means additional spending to placate coalition partners.

4.) For Markets: There are several items worth flagging here:

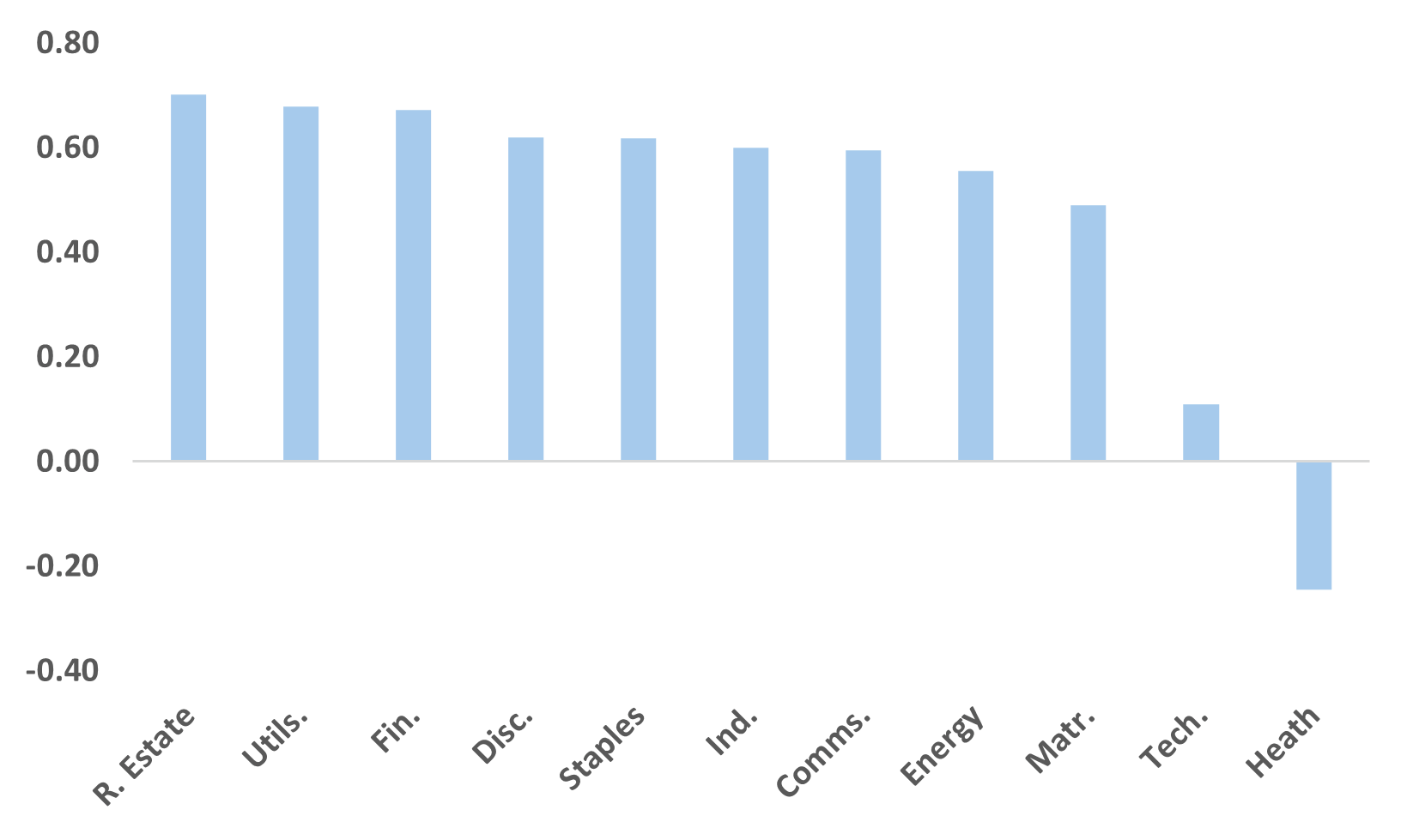

a.) Spending on housing, infrastructure and defense are priorities for almost all of the parties. That is constructive for the following sectors: industrials, utilities, materials, financials and (maybe) real estate.

Of the above, we’d surmise that industrials and utilities are best positioned. The former should benefit given the intense focus on transport and defense spending while the latter does surprisingly well during periods of housing construction. Some may also point out tailwinds for real estate and financials potentially, but those are still a bit too pro-cyclical given where we are in the economic cycle here in Canada.

Chart 2 – Cdn Sector Correlation to CAD Housing Starts (1989-present)

*Monthly correlation going back to January 1989

Source: BMO GAM

b.) For fixed income, there are a lot more questions than answers right now.

At the front-end, the market is of the mind that the BoC will end its current easing cycle at 2.25%. That feels fair for now, not least as any Liberal-led coalition will likely rely heavily on spending which should circumvent the need for stimulatory monetary policy.

Duration could come under some pressure though. We’ll get the details closer to the budget in terms of overall debt management strategy.

c.) Thus far, the Canadian dollar is taking the news in stride. We had expected that a minority government would lead to some residual weakness, but price action in USD/CAD appears to be contained.

5.) Trade and Tariff Implications: So far, Trump has announced the following tariffs that impact Canada:

- 25% on all imports + 10% on energy (only affects goods that are non-USMCA compliant)

- 25% on steel and aluminum

- 25% on autos and parts

PM Carney’s team will almost certainly be working to negotiate something with the Trump administration. Though Trump’s team is likely to be extremely busy in the coming months negotiating with other countries on reciprocal tariffs ahead of the deadline date in early July.

However, keep in mind that the existing USMCA deal expires next year, and there are likely more sector-specific tariffs in the cards (lumber, agriculture). When taken with the other imbalances still lurking in the CAD backdrop (household debt) and the general impact that the lack of clarity has on spending/investments, there is an elevated chance that the Canadian economy will tip into a recession soon. That still portends to risk when it comes to the broad CAD equity and credit markets in the near-term.

6.) Portfolio Strategy: Given the above, here are the funds and strategies that we like going forward:

- Sectors: ZUT and ZIN (utilities and industrials both feel like sectors that should outperform relative to the broad market).

- Protection against recession risk: We like ZLB and ZMMK

- Yield enhancement: ZWU and ZDV