Weekly Basis Points - Checking in on our Balanced Portfolio

16 févr. 2026- The balanced portfolio remains aligned with a late‑cycle/slow‑disinflation regime, but strong performance from metals and gold has created concentration risk, elevated volatility drift, and pushed fixed‑income exposure below its tolerance band.

- ZMT and ZWGD have driven most of the ~5.4% Q1 gain so far, but their increased volatility contribution is causing efficiency concerns and prompting a need to rebalance.

- To restore allocation discipline and reduce drift, the portfolio trims ZMT while increasing positions in ZDB and ZUAG/F, bringing both fixed‑income and equity weights closer to target.

- Broader strategy views: US data remains mixed but consistent with the current macro regime; USD positioning is extremely bearish and may be due for reversal; tech earnings are strong but valuation‑related “P/E disinflation” tempers re‑entry; key data releases this week include CAD CPI, FOMC minutes, and US GDP/PCE.

We’re about midway through the first quarter for 2026. This is a good point to take a quick snapshot of our model balanced portfolio to gauge whether we need to make any tactical shifts or tilts.

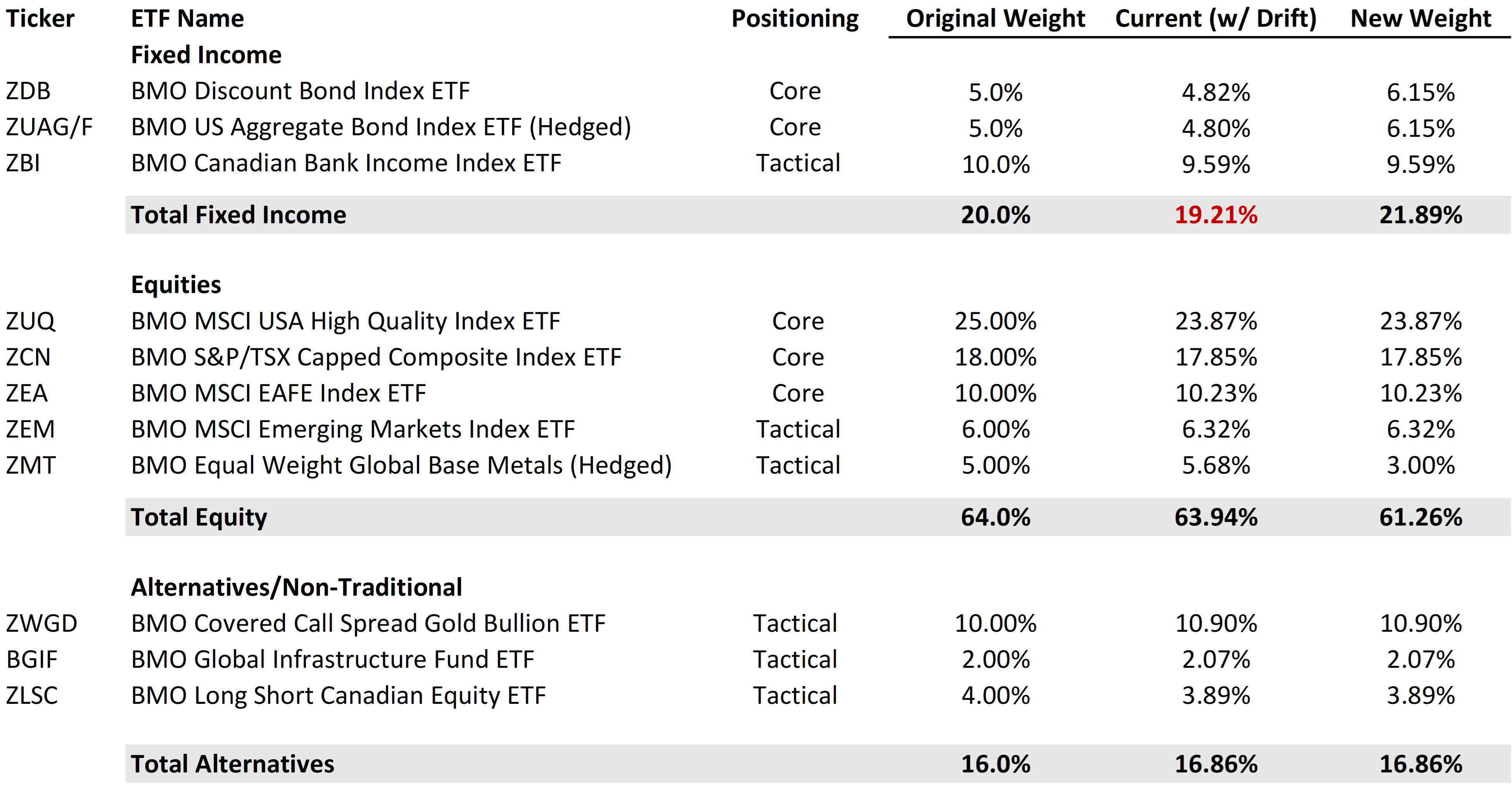

Table 1 shows the Q1 edition of our portfolio as it was when we last adjusted the weights on December 31st. A few points to highlight:

- The general nature of the portfolio is still consistent with a late cycle/slow disinflation macro regime. We’ve now labelled this as a ‘late-cycle dispersion’ regime. Regular readers will recall that we’ve skewed allocation towards this theme for several quarters now.

- However, the tactical positions show a strong real asset tilt. That comes via direct exposure to gold (ZWGD), and indirect exposure to base metals (ZMT and to a lesser degree, ZEM) as well as infrastructure (BGIF).

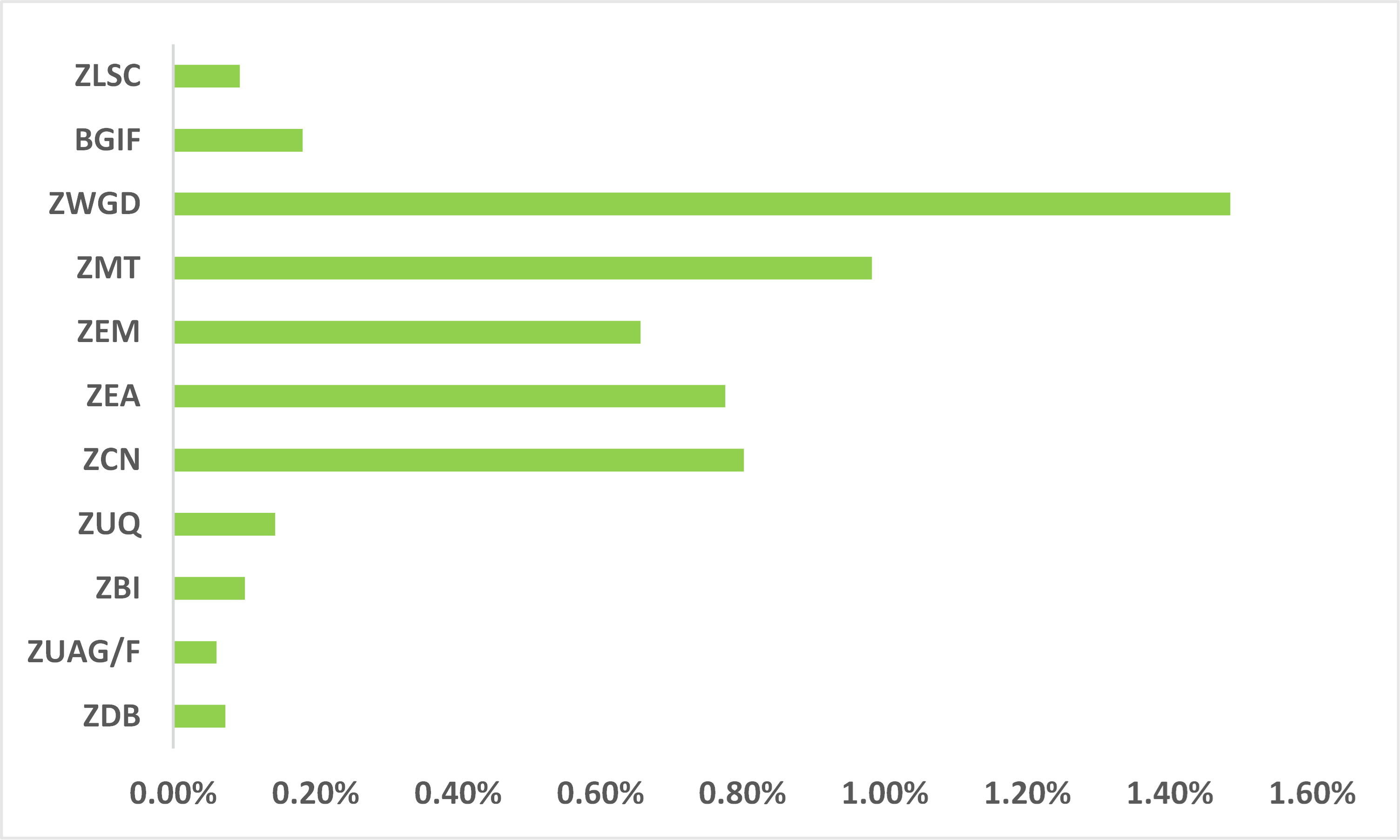

Of course, this was done deliberately to capitalize on the fact that the geopolitical situation is shifting. In this environment, commodity importers were expected to front-load demand for copper, aluminum, nickel, etc. At the same time, we remained long gold in expectation that some momentum would carry through into 2026. Those views have served us well, with the portfolio currently up around 5.4% for the quarter – and the contribution from our allocations to ZMT and ZWGD accounting for most of that gain so far (see Chart 1).

However, the primary risk with this version of the portfolio is that there is a fair bit of ‘clustering’ to the commodity story. For instance, the volatility contribution to the overall portfolio from ZMT and ZWGD has also gone up by over 5% since the start of the quarter (as the recent moves in gold clearly reflect why this has happened).

An increase in volatility of this scale can be problematic because it leads to ‘volatility drift’ (or variance drag). The larger this drift, the more that it will reduce compounded returns over time. For example, those two securities are a big part of the reason why the volatility drift for the overall portfolio has increased from 0.68% to about 1.05% now – implying that average returns will need to be that much higher. In other words, this means the portfolio must work harder to achieve the same compounded returns if volatility becomes too concentrated.

An additional issue is that we’re now below the tolerance band for our fixed income sleeve. Indeed, the benchmark for this sleeve is 30% with a tolerance band of +/-10%. We’ve been underweighting fixed income for several quarters now with a target of 20% for this sleeve. However, the outperformance in our metals positions effectively means that the portfolio has drifted such that our aggregate fixed income position now accounts for about 19.2% of the overall portfolio.

As such, we’re making the following change to our portfolio (also reflected in Table 1):

- We are trimming our position in ZMT to 3% of the portfolio.

- We are increasing our position in ZDB to 6.15%.

- We are increasing our position in ZUAG/F to 6.15%.

The new weights reflect the effects of drift alongside the above changes. Eagle-eyed observers will also note that this also means that our total equity allocation is closer to our ‘neutral’ target weight of 60% for the portfolio as well. This fits in with how we’d like to position risk into the end of Q1.

Given the outsized contribution from metals and gold — and the resulting impact on both volatility drift and our fixed‑income weight — we’re making targeted adjustments to restore balance without sacrificing our core macro view. Trimming ZMT while increasing ZDB and ZUAG/F brings the portfolio back within risk and allocation thresholds and positions us more comfortably for the remainder of the quarter.

Table 1 – Q1 Balanced Portfolio (Original and Revised Weights)

Source: BMO GAM

Chart 1 – Performance Contribution by Security for Q1 Balanced Portfolio

Portfolio Strategy

a.) What did we make of US data last week?

On the surface, the nonfarms beat and subtle hints of slow disinflation from the CPI number should be music to the ears of the FOMC. However, both prints are skewed:

- The January nonfarms print was basically all about healthcare jobs.

- The January CPI number was largely about deceleration in food/energy prices. The core print was still a bit firmer due to a rise in transport services costs.

Nevertheless, those numbers won’t change the temperature much. The Fed is still expected to ease rates by mid-summer – and there are plenty of inflation and nonfarms prints ahead of then. This is still fairly consistent with the current macro regime that we appear to be settling in (uneven growth + slow disinflation = ‘fractured’ expansion).

What it doesn’t quite explain is the recent rally in rates (lower UST yields). Our own view is that this move lower in US yields reflects a semblance of relief that Warsh was picked over Hassett and that geopolitical volatility has abated to a degree for now. We expect US 10s will find settle in around the 4.00% mark for the next few weeks.

b.) USD shorts are at their extreme

We can extract this from recent data in the futures market (from net non-commercial positions) as well as the shift in interest for USD calls that are out-of-the-money in the FX options market against other currencies. Investors are just incredibly bearish on the US dollar right now.

We’ll have more to say on this in a future note, but we’ll make the following observations now:

- When positioning gets this extreme, you want to fade it in the near-term. Tactical FX trading is mostly a mean reversion thing.

- This isn’t about foreigners divesting US assets. It’s about them increasing their hedge ratios (“Hedge America” » “Sell America”).

Our view on the USD is that you can get better levels to hedge over the medium-term. In English, that means that you should look at near-term rallies in the USD as opportunities to increase hedges on US equities.

c.) Tech earnings are strong…but when do you buy again?

Despite strong earnings momentum – the tech sector continues to underperform. This is largely due to high valuations alongside meaningful concern over AI developments and what they mean for the software industry.

Given what we know, price movements in the latter feel overdone for now. Nevertheless, we’ll admit that there is still additional room for ‘P/E disinflation’ before we look to get involved again.

d.) Data this week

Among the more important datapoints out this week – the following are most important:

- CAD CPI (January) – Tuesday at 8:30am

- FOMC minutes – Wednesday at 2:00pm

- US Q4 GDP + Jan PCE – Friday at 8:30am

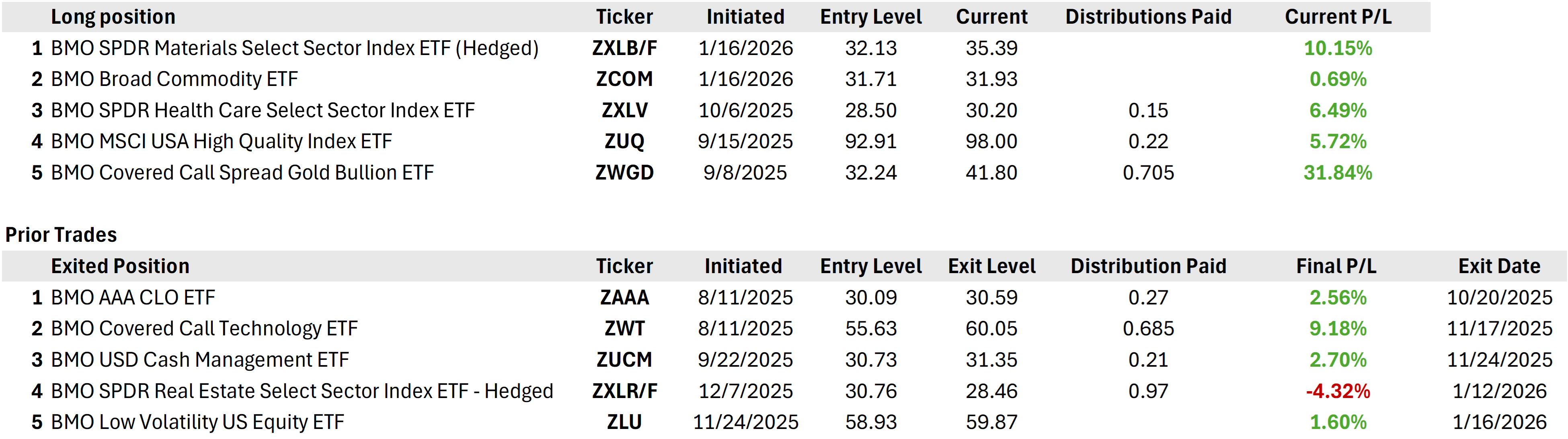

We are not making any changes to our tactical trade portfolio this week.

Book of Trades

Asset views

Equities |

Overweight Earnings remains solid, but broader participation remains the play for now. In the US, we like value and equal weight strategies as tactical plays for now with a preference for quality over the long-term. |

Fixed Income |

Underweight We prefer spread product exposure (IG credit) to sovereign fixed income. |

Alternatives |

Overweight A more fractured trade backdrop lead to front-loading of commodity demand from importers. We still see upside for energy and metals for now. As a region, this should benefit Latin America. |

Currency: |

Neutral We are neutral on the US dollar in the near-term (1−2 months), and bearish over the long-term. Increased hedging activity on foreign USD exposure is the primary reason for our long-term view. |