BMO Covered Call ETFs Methodology

Enhanced Cashflow with Covered Calls

Feb 11, 2024

| BMO Covered Call ETF | Ticker | BMO High Dividend Covered Call ETF | Ticker |

| BMO Covered Call Canadian Banks ETF | ZWB/ZWB.U | BMO BMO Canadian High Dividend Covered Call ETF | ZWC |

| BMO Covered Call Dow Jones Industrial Average Hedged to CAD ETF | ZWA | BMO US High Dividend Covered Call ETF | ZWH/ZWH.U/ZWS |

| BMO Covered Call Utilities ETF | ZWU | BMO Europe High Dividend Covered Call ETF | ZWP/ZWE |

| BMO Covered Call US Banks ETF | ZWK | BMO Global High Dividend Covered Call ETF | ZWG |

| BMO Covered Call Technology ETF | ZWT | BMO Global Enhanced Income Fund ETF Series | ZWQT |

| BMO Covered Call Energy ETF | ZWEN | ||

| BMO Covered Call Health Care ETF | ZWHC |

The covered call option strategy, also known as a buy – write strategy, is designed to provide an investor with a double source of cash flow: an option premium plus the dividend yield. This distribution is tax efficient.* The strategy is implemented by writing (selling) a call option contract, while owning the underlying stock. It is considered an income enhancement strategy because it generates additional cash flows compared to only owning the underlying stock. It is also considered a defensive strategy as equity downside returns are reduced by the option premiums as a trade off from excess positive returns.

A call option is a contract which allows the owner the right to purchase the underlying stock at a predetermined price (the strike price) over a specific time period. Conversely, the writer (seller) of the call option is obligated to sell the stock to the buyer at the stated strike price. The buyer of the call option pays the writer a premium to access to this right. If the stock price rises above the exercise price, the owner will exercise their option, and purchase the underlying at a discount to market value. If the stock price remains below the exercise price, the option-holder will let the option expire worthless.

The price of the option will be determined based on the difference between the stock price and the exercise price, the volatility of the underlying stock (where greater volatility leads to a higher price) and the time to expiration of the option contract (where a longer time period leads to a higher price).

The covered call option strategy allows the portfolio to generate cash flow from the written call option premiums in addition to the dividend income from the underlying stocks. Over the long-term, covered call strategies have provided a similar overall return to the underlying portfolio with a significantly lower risk level. BMO Covered Call ETFs are income focused products, designed to provide equity exposure with a sustainable and attractive yield. This strategy appeals to investors who are looking for a high level of income, as well as the potential for capital gains.

Breaking down the return of a Covered Call ETF

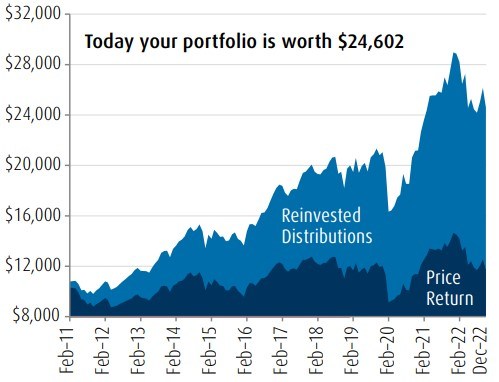

$10,000 investment in ZWB at inception (Feb. 1, 2011)

Monthly Distributions Reinvested

Portfolio Value as of December 30, 2022. The chart illustrates the impact to an initial investment of $10,000 dollars from Feb 1, 2011 to December 30, 2022 in BMO Covered Call Canadian Banks ETF (ZWB). It is not intended to reflect future returns on investments in ZWB.

Mechanics of Covered Calls

The BMO ETFs sell out of the money (OTM) call options on 50% of the stocks which cap the return of the written positions at the option strike price until the option expires. For BMO ETFs, option expiries are generally 1 to 2 months.

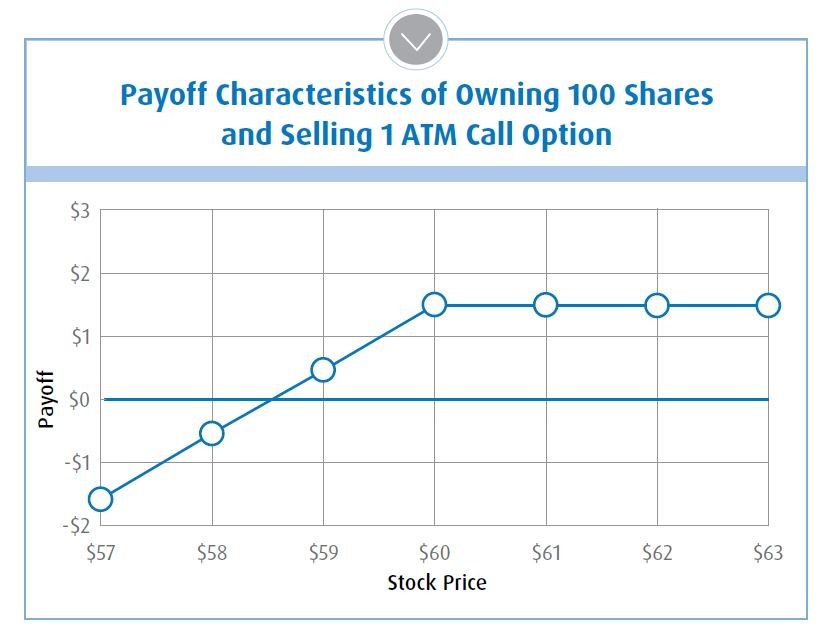

As an example, consider a portfolio that consists of 100 shares of a stock at a current price of $60, for a total value of $6,000. At the money (ATM) call options (strike price of $60) that expire in one month are valued at a premium of $1.50 per contract. To implement a covered call strategy, the Portfolio Manager writes call options on 100 shares and receives $150 in premium.

Payoff without exercise: Premium received adjusted for any difference in stock price. If the stock price remains at $60, the calls are not exercised, and the portfolio benefits from the premium received. The new portfolio value is $6,150.

Break even point: Stock purchase price less premium received. If the stock price drops to $58.50, the calls are not exercised, but the portfolio value drops. The new portfolio value is $6,000 ($5,850 + $150). The portfolio will devalue at any price below $58.50.

Payoff with exercise: Premium received adjusted for any difference between stock price and exercise price. If the stock price rises to $62, the calls are exercised at $60 eliminating the benefit of the rising stock price except for the premium received. The new portfolio value is $6,150.

Impact of Market Conditions

Covered call strategies tend to outperform in flat or down markets, and underperform in periods of rapid market appreciation.

The covered call option strategy is most effective when the underlying stocks are range bound, meaning that the stock’s price is not overly volatile. The strategy will participate in the stock appreciation up to the strike price, with the added benefit of the sold call premium.

When the stock price rises significantly and exceeds the strike price, the call option will move into the money. This caps the gain for the call writer based on the strike price and premium received.

The strategy provides limited protection when the stock price declines significantly, as the decline of the underlying stock portfolio is partially offset by the call premium received.

In volatile markets, the covered call option strategy will provide the exposure of the underlying stock portfolio with less volatility. The covered call strategy may outperform or underperform the underlying stock portfolio under these conditions.

Call Writing Implementation

OTM call options are sold on approximately 50% of the portfolio, depending on market conditions. This gives the investor an enhanced yield and still allows for participation in rising markets. The selection of the option’s strike price will depend on the available option premiums and general economic conditions. We sell further OTM when volatility rises and closer to the money when volatility drops. When volatility rises, the option increases in price.

We sell options with 1 to 2 months to expiry in order to take maximum advantage of time decay. Options experience more time decay impact, the closer they are to expiry. Writing shorter term options provides greater flexibility to adjust options strike price more frequently to capture more upside.

The BMO Covered Call Strategy strikes a balance between generating income and participating in rising markets. This approach can potentially provide exposure to the underlying portfolio with significantly less risk.

BMO’s Covered Call ETFs

| BMO Covered Call ETF | BMO Covered Call Energy ETF | BMO Covered Call Health Care ETF | BMO Covered Call Canadian Banks ETF | BMO Covered Call US Banks ETF |

| Ticker | ZWEN | ZWHC | ZWB/ZWB.U | ZWK |

Exposure | Equally weighted Global Energy companies | Equally weighted US Healthcare & Healthcare related companies | Canadian banks, equal weighted | US banks, equal weighted |

| Management Fee | 0.65 | 0.65 | 0.65 | 0.65 |

| Inception Date | Jan 26th 2023 | Jan 26th 2023 | Jan 28 2011 | Feb 15 2019 |

| BMO Covered Call ETF | BMO Covered Call Utilities ETF | BMO Covered Call Dow Jones Industrial Average Hedged to CAD ETF | BMO Covered Call Technology ETF |

| Ticker | ZWU | ZWA | ZWT |

| Exposure | Utilities, telecommunications and pipeline companies, equal weighted | Dow Jones Industrial Average companies, price weighted | North American Technology and Technology-related companies |

| Management Fee | 0.65 | 0.65 | 0.65 |

| Inception Date | Oct 20 2011 | Oct 20 2011 | Jan 26 2021 |

BMO’s High Dividend Covered Call ETFs

BMO ETFs employs a proprietary 4 step, rules‑based portfolio construction strategy to manage its dividend ETFs, focusing on quality and fundamental screening to avoid deteriorating companies.

For more information on BMO’s dividend ETF strategy, please read our white paper BMO Dividend ETFs Portfolio Construction Methodology

| BMO Covered Call ETF | BMO Global High Dividend Covered Call ETF | BMO Canadian High Dividend Covered Call ETF | BMO Europe High Dividend Covered Call ETF / BMO Europe High Dividend Covered Call Hedged to CAD ETF | BMO US High Dividend Covered Call ETF / BMO US High Dividend Covered Call Hedged to CAD ETF |

| Ticker | ZWG | ZWC | ZWP/ZWE (hedged) | ZWH/ZWH.U/ZWS (hedged) |

| Exposure | Dividend paying global companies, total dividends weighted | Dividend paying Canadian companies, total dividends weighted | Dividend paying European companies, total dividends weighted | Dividend paying U.S. companies, total dividends weighted |

| Management Fee | 0.65 | 0.65 | 0.65 | 0.65 |

| Inception Date | Jan 21 2020 | Feb 9 2017 | Mar 7 2018 | Feb 10 2014 |

| Considerations | 25% cap per sector. | 40% cap per sector. | 25% cap per sector. | 25% cap per sector. |

*As compared to an investment that generates an equivalent amount of interest income

This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by the Manager. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Manager. The ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.